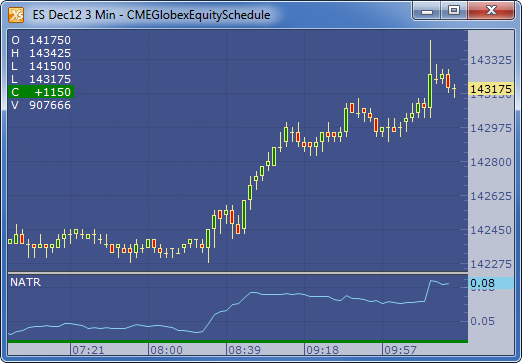

Normalized Average True Range Indicator

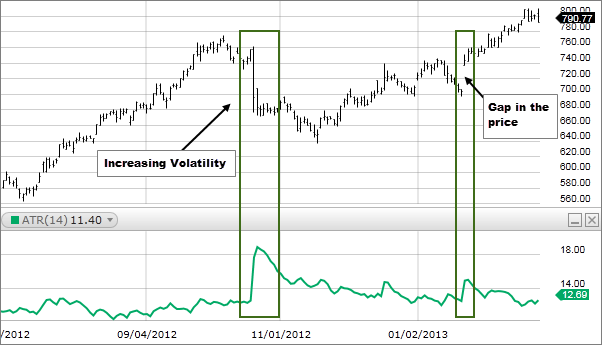

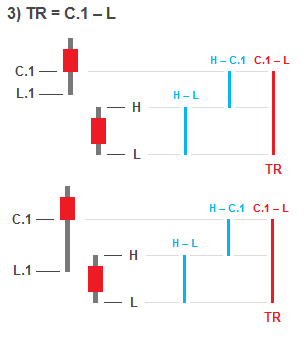

The larger the range of the candles the greater the atr value and vice versa.

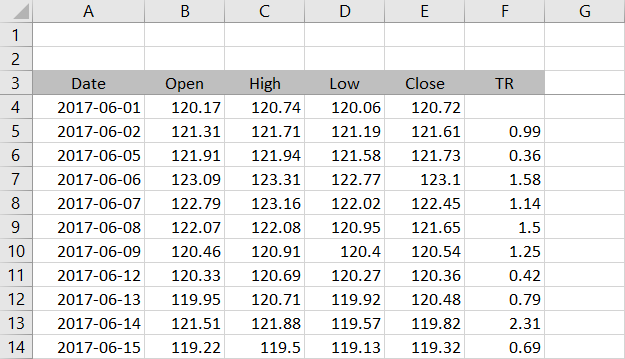

Normalized average true range indicator. For example a stock trading around 10 with atr of 0 5 is actually more volatile than a stock trading around 200 with a much greater atr of 2. Average true range atr is a technical analysis volatility indicator originally developed by j. Average true range atr is a very useful measure of volatility but it has downsides because it is derived from range or to be precise true range and expressed as absolute dollar value it is not directly comparable across securities and over time. To adjust the period setting highlight the default value and enter a new setting.

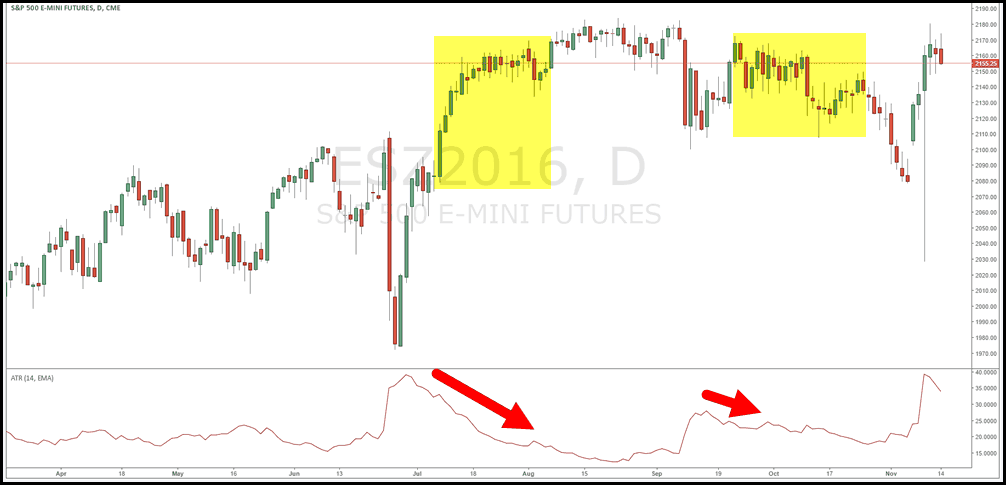

For example a value of 1 indicates a true range of 1 in a given period. Average true range atr is a volatility indicator that shows how much an asset moves on average during a given time frame. Now a mistake traders make is to assume that volatility and trend go in the same direction. This indicator creates a moving average of the volatility of a product going back x number of periods and is useful for deciding what to trade.

The parameters box to the right of the indicator contains the default value 14 for the number of periods used to smooth the data. The average true range is an n period smoothed moving average smma of the true range values. Cross market evaluations with normalized average true range. The average true range indicator measures the volatility of the market.

Normalized average true range is a measure of volatility. Normalized average true range is calculated by normalizing average true range with the following formula. For example if used on a daily chart one product displays a value of 4 you can. It is typically derived from the 14 day moving average of a series of true range indicators.

Average true range atr is a technical indicator measuring market volatility. The indicator does not provide an indication of price trend simply the degree of price volatility. Forman uses a normalized average true range indicator to analyze tradables across markets. The atr indicator is not a trending indicator.

The indicator can help day traders confirm when they might want to initiate a trade and it can be used to determine the placement of a stop loss order. As is it average true range of an instrument can be easily compared to any other because of absolute percentage variation and not prices itselves. Wilder recommended a 14 period smoothing. Because normalized average true range is normalized it can be more useful than average true range when comparing across different price levels.

In his work wilder often used an 8 period atr. The average true range percent is the classical atr indicator normalized to be bounded to oscillate between 0 and 100 percent of recent price variation.

/ATR-5c535f8fc9e77c000102b6b1.png)